The Federal Reserve wants markets to fall – here’s what that means for investors

The Federal Reserve’s primary mandate is to keep inflation down, and lower asset prices help with that. So, asks Dominic Frisby – just how low will stockmarkets fall?

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Not being a Fed-watcher, I have been rather slow to this particular narrative I’m afraid, and it only really dawned on me last week as I was losing money trying to catch falling knives in the stockmarket.

It was Zoltan Pozsar writing for Credit Suisse who switched on the lightbulb for me. He’s the new rockstar among institutional market strategists.

A couple of other analysts have reached the same conclusion. It’s this: the Federal Reserve and America’s other policy-making powers that be, actually want the stockmarket lower.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The Federal Reserve really does want to fight inflation

I’ve heard so much hot air coming out of government officials’ mouths over the years that I think my mind is actually programmed now not to believe a word they say.

It’s not that I’m treating what they say with a healthy dose of cynicism; I’ve reached unhealthy levels of cynicism. My default, so low is my trust, is now not only not to believe a word they say, it is to assume they are lying. Probably not a good place.

It turns out that sometimes those in power do actually tell the truth. I got my first surprise dose of this earlier this year from Liz Truss, the foreign secretary, when she warned that the Russian troops on the other side of the Ukrainian border were about to invade.

Pull the other one, I thought – Russia wouldn’t do that. It turned out that Truss was talking straight, and her intelligence was correct.

When US president Joe Biden said his top economic priority was getting inflation down, my inner cynic muttered: “yeah, course it is mate.” It turns out what he was saying might actually, believe it or not, be true.

The Federal Reserve’s primary mandate is to keep inflation down. It might be that its chief, Jerome Powell, is taking this mandate at face value. All that stuff about his hero being Paul Volcker might even be true too.

Lower asset prices help the cause.

Back in 2008, and for many years since, everyone in Policymakerland was worried about deflation, and every effort went into staving it off. So we got QE (quantitative easing), ZIRP (zero interest rate policy) and all the rest of it. We got very used to it. It went on for so long, it became normalised. The idea that they would ever do anything else seemed far-fetched.

But, no, in Policymakerland they are genuinely worried about inflation, and so asset prices are not going to be defended. Au contraire. They want them to fall.

Bear markets mean financial conditions tighten. Tighter financial conditions mean lower money velocity and lower inflation, according to modern definitions at least.

The Fed is talking tough, and it might be that talking tough does a lot of the job for them – and they might not have to actually act as tough as they talk.

If they can get stock prices down a bit, house prices down a bit, and a lot more caution around the place, with just a bit of jawboning, then the need for higher interest rates will diminish, and the Western world might not actually implode.

Falling cryptocurrency markets help the cause too. There won’t be that particular thorn in the Fed’s side exposing the shortcomings of fiat money.

Tighter conditions will put some upward pressure on unemployment, which means the upward pressure on wages will go away too, and that will help reduce inflation.

If this has to happen some time, that time is now, in the second year of an election cycle. Come 2023, the priority will shift to getting the economic conditions in place to win the next election. Part of this of course is lower inflation, but they will want the correction in the past and asset prices moving back up again.

OK. So if you buy this theory – how far do stocks fall?

How low can the S&P 500 go?

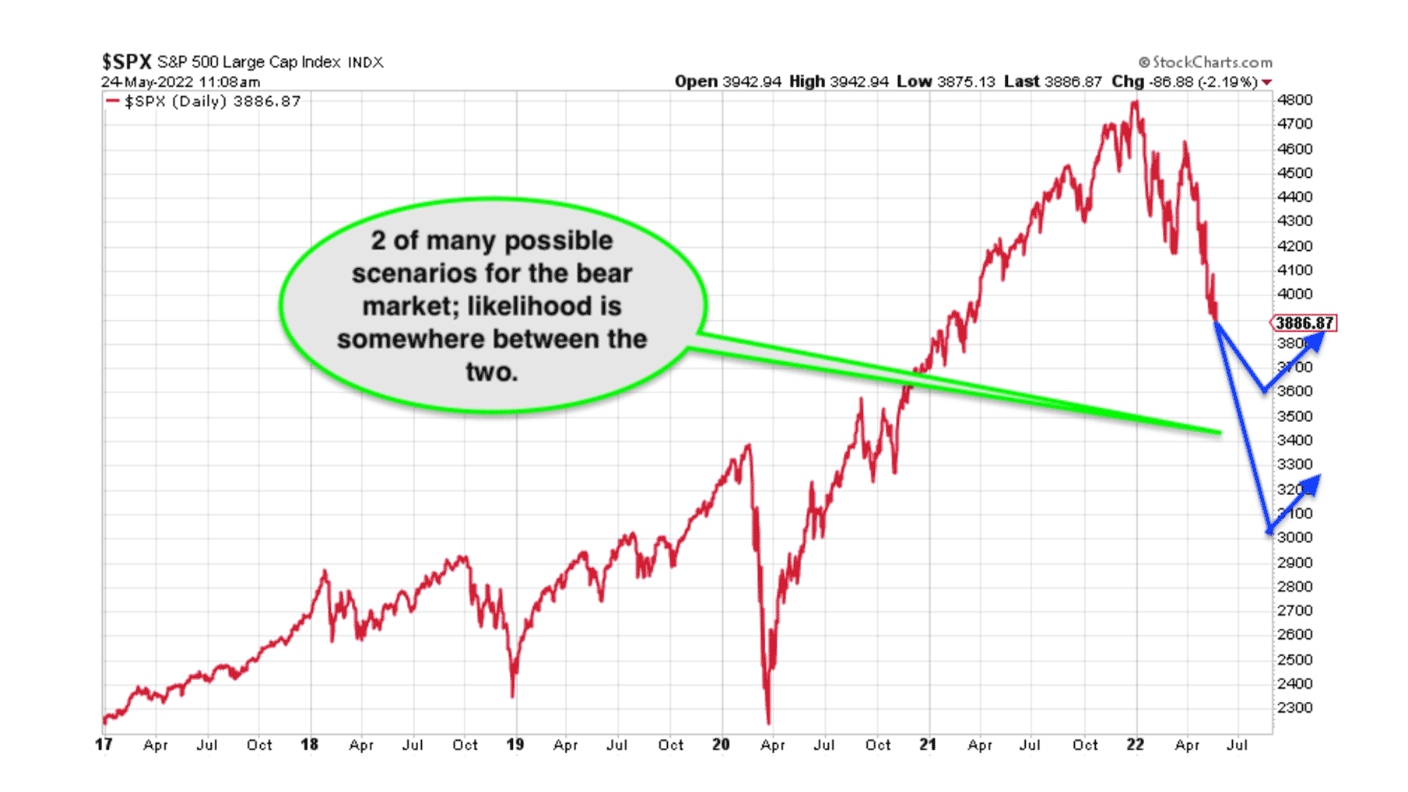

Currently we are at 3,880 on the S&P 500, having been as high as 4,800, so we are off about 20%. Another 10% or 15% would take us to the low 3,000s.

Best-case scenario, I’m going to say 3,600 – that’s the post Corona-panic high. Worst case? Down around 3,000 at the 2019 highs. Most likely, I’m going to guess somewhere in the middle at 3,400 – the 2020 pre-lockdown highs.

But the bottom line is this: the “print money and protect asset prices at all costs” narrative has gone; it’s history.

The issue is no longer deflation, by their definition. Now it’s about inflation. They’ve been able to ignore it for years by crooked measures, ignoring asset prices and all the rest of it. They can’t any longer. That’s what they are now fighting.

As they say, “don’t fight the Fed”.

It won’t be the case forever – elections have to be won – but it seems the case for now.

Psychologically, we might need some despair and maximum pessimism before the bear market can be deemed over. There still seems to be too much optimism about. We need to be at that point of perception that the bear market is entrenched and we are never going to get out of it before it can end; we haven’t reached that point yet.

Everything bubbles on the way up, everything pops on the way down.

It might be, by the way, that UK stocks – small and large – turn out to be a very good place to hide (I’m not saying the UK economy – stockmarkets and economies are different beasts).

My reasoning? A presentation by fund manager Gervais Williams that I saw at the UK Investor Show last weekend. UK stocks have been rubbish for 20 years, but in the inflation of the 1970s they were one of the best global places to park capital. Fingers crossed the same thing happens this time around.

Dominic’s film, Adam Smith: Father of the Fringe, about the unlikely influence of the father of economics on the greatest arts festival in the world is now available to watch on YouTube.

SEE ALSO:

We’re in a bear market – change the way you invest

Everything is collapsing at once – here’s what to do about it

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

Is it different this time for Japanese stocks?

Is it different this time for Japanese stocks?Analysis Nikkei 225 Index has jumped 19.8% this year, and there are signs the rally could continue.

-

As China reopens, why pick an income strategy?

As China reopens, why pick an income strategy?Advertisement Feature Yoojeong Oh, Investment Manager, abrdn Asian Income Fund Limited

-

Is Japan the best market to invest in now?

Is Japan the best market to invest in now?Opinion Japan puts Western economies to shame and offers good value for both equity and bond investors, says Max King.

-

The highest yielding S&P 500 Dividend Aristocrats

The highest yielding S&P 500 Dividend AristocratsTips Dividends are a key component of investment returns in the long-term. A portfolio of dividend aristocrats is a great way to build wealth and a sustainable income stream.

-

2023 will be a bumper year for stocks. Here’s how to play the rally

2023 will be a bumper year for stocks. Here’s how to play the rallyTips Dominic Frisby explains why he thinks the market rally could have further to run in 2023 despite macroeconomic headwinds

-

A new dawn for Asian markets?

A new dawn for Asian markets?Advertisement Feature James Thom, Investment Manager, abrdn New Dawn Investment Trust plc

-

China’s post-covid investment boom off to a slow start. Should you still invest in China?

China’s post-covid investment boom off to a slow start. Should you still invest in China?Advice Investors are no longer bullish on the China shop but the gloomy consensus on Beijing’s economy might be unfair. Should you invest in China?

-

Stock market crash? This time it’s (slightly) different

Stock market crash? This time it’s (slightly) differentOpinion The bears expecting a stock market crash have got it wrong, says Max King.