Currencies: the yen just keeps on tumbling

The Japanese yen is trading close to a 20-year low with the US dollar, with the Bank of Japan in no rush to raise interest rates.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

Japan has become “the land of the sinking currency”, says Russ Mould in Shares. The yen is trading close to a 20-year low at 130 to the US dollar, having fallen 16% over the past 12 months. The main cause is divergent monetary policy: while US policymakers rush to tame inflation running at more than 8%, inflation in Japan is still below target at only 1.2%.

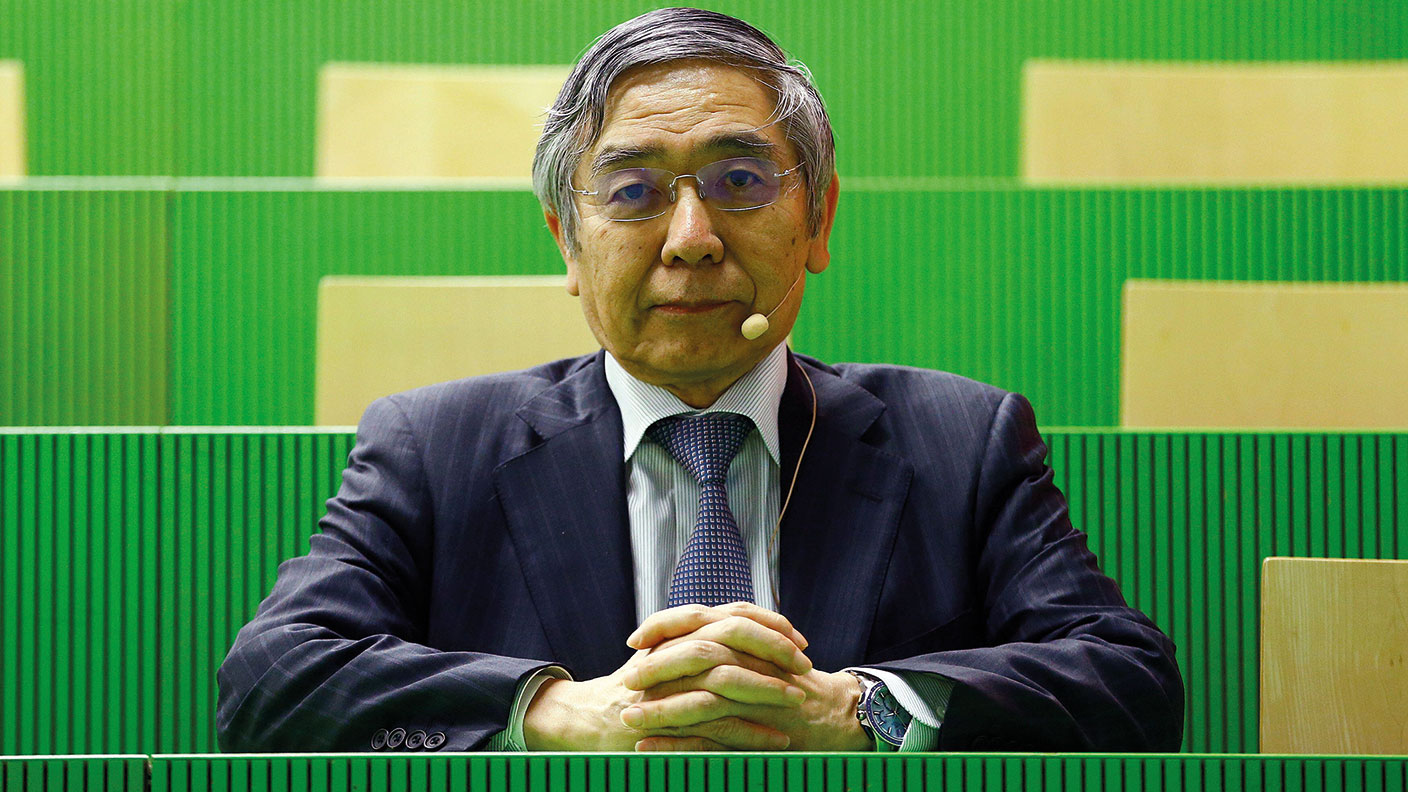

Thus Bank of Japan governor, Haruhiko Kuroda, is in no rush to raise short-term interest rates from -0.1% or to abandon yield-curve control, a policy that caps ten-year government bond yields at 0.25%. In any case, while politicians have begun to “fret” about the weaker yen raising the cost of living, there is little they can do, says The Economist. “Deep forces are driving the yen’s depreciation…Fuel and raw materials make up roughly one-third of Japan’s import bill”, leaving the country especially exposed to the global commodity price spike. Some think “the yen could continue falling, perhaps to ¥150 to the dollar, a level unseen even during the Asian financial crisis of 1997-1998 (when it fell to ¥147 to the greenback)”.

A fading export power

The yen is now at its lowest level in real terms since the early 1970s, says the Financial Times. In past decades, “such weakness would have prompted furious recriminations between Tokyo and Western capitals, which lived in fear of cheap Japanese imports”. But times have changed. A weak yen will see Japan soak up global inflation, while exporting deflation. That’s just what “an inflation-hit US wants”.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

The weak yen could be a buying opportunity, says David Brenchley in The Sunday Times. Historically, Japanese stocks do well when the yen weakens. A weaker currency makes Japanese exports more competitive and flatters the earnings of multinationals in yen terms. “Between September 2012 and June 2015 the yen fell 60%, while the Nikkei 225 index of large Japanese companies rose 120%.”

But the idea that a weak yen is good for Japan’s export-oriented economy is “a distorted echo of the past”, say Marc Chandler and Omkar Godbole in Barron’s. At 15% of GDP, exports now account for a smaller part of Japan’s economy than the UK’s (28%) or Germany’s (43%). Offshoring means that Japanese exporters get less of the upside from a weaker yen than they used to.

For example, two-thirds of the cars that Japanese firms sell are made abroad, say Satoshi Sugiyama and Maki Shiraki for Reuters. “Almost a quarter of Japanese manufacturers’ production is carried out overseas”, up from less than 15% two decades ago. Kuroda insists that the current spurt of inflation will help Japan shake off its deflation problem. He may be right, but “some of Kuroda’s former finance ministry colleagues now see the weak yen as a sign of Japan’s fading economic power”.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alex is an investment writer who has been contributing to MoneyWeek since 2015. He has been the magazine’s markets editor since 2019.

Alex has a passion for demystifying the often arcane world of finance for a general readership. While financial media tends to focus compulsively on the latest trend, the best opportunities can lie forgotten elsewhere.

He is especially interested in European equities – where his fluent French helps him to cover the continent’s largest bourse – and emerging markets, where his experience living in Beijing, and conversational Chinese, prove useful.

Hailing from Leeds, he studied Philosophy, Politics and Economics at the University of Oxford. He also holds a Master of Public Health from the University of Manchester.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King

-

Why you should keep an eye on the US dollar, the most important price in the world

Why you should keep an eye on the US dollar, the most important price in the worldAdvice The US dollar is the most important asset in the world, dictating the prices of vital commodities. Where it goes next will determine the outlook for the global economy says Dominic Frisby.

-

What is FX trading?

What is FX trading?What is FX trading and can you make money from it? We explain how foreign exchange trading works and the risks

-

The Burberry share price looks like a good bet

The Burberry share price looks like a good betTips The Burberry share price could be on the verge of a major upswing as the firm’s profits return to growth.

-

Sterling accelerates its recovery after chancellor’s U-turn on taxes

Sterling accelerates its recovery after chancellor’s U-turn on taxesNews The pound has recovered after Kwasi Kwarteng U-turned on abolishing the top rate of income tax. Saloni Sardana explains what's going on..

-

Why you should short this satellite broadband company

Why you should short this satellite broadband companyTips With an ill-considered business plan, satellite broadband company AST SpaceMobile is doomed to failure, says Matthew Partridge. Here's how to short the stock.

-

It’s time to sell this stock

It’s time to sell this stockTips Digital Realty’s data-storage business model is moribund, consumed by the rise of cloud computing. Here's how you could short the shares, says Matthew Partridge.

-

Will Liz Truss as PM mark a turning point for the pound?

Will Liz Truss as PM mark a turning point for the pound?Analysis The pound is at its lowest since 1985. But a new government often markets a turning point, says Dominic Frisby. Here, he looks at where sterling might go from here.

-

Are we heading for a sterling crisis?

Are we heading for a sterling crisis?News The pound sliding against the dollar and the euro is symbolic of the UK's economic weakness and a sign that overseas investors losing confidence in the country.