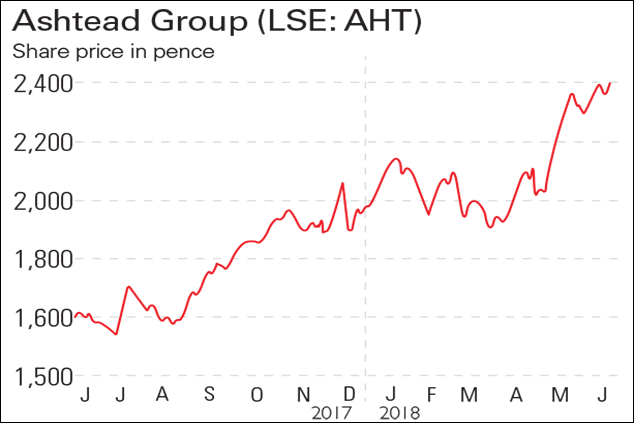

If you’d invested in: Ashtead Group and Esure

Over the last decade, the shares of construction and industrial equipment rental firm Ashtead Group have risen by almost 2,700%.

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

If only...

Ashtead Group (LSE: AHT) rents out construction and industrial equipment. Over the past decade, its shares have risen by almost 2,700%. A combination of a building boom and hurricanes in the US has driven demand for Ashtead's rental equipment, which has boosted profits and revenues. Over the past five years, revenue has increased from £1.1bn to £3.2bn, a compound annual growth rate (CAGR) of 23%. During the same period, net profit climbed from £89m to £501m, a CAGR of 41%. For the first nine months of this year, rental revenue increased by 21%.

Be glad you didn't buy

Esure Group (LSE: ESUR)

provides insurance services in the UK. Its share price briefly plunged in September following reports that founder Peter Wood was trying to sell his controlling stake in the firm, currently 30.7%. In March, Esure reported a better-than-expected 35.6% increase in full-year profit before tax, driven by a rise in demand for motor insurance products. Its gross written premiums also rose by 25.2% to £820.2m. Shares rallied. However, the home-insurance division saw declines, and last month Esure warned about increasing competition.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Alice grew up in Stockholm and studied at the University of the Arts London, where she gained a first-class BA in Journalism. She has written for several publications in Stockholm and London, and joined MoneyWeek in 2017.

Alice is now Consumer Editor at The Sun and covers everything from energy bills to Social Security.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King