Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

You are now subscribed

Your newsletter sign-up was successful

Want to add more newsletters?

Twice daily

MoneyWeek

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

Four times a week

Look After My Bills

Sign up to our free money-saving newsletter, filled with the latest news and expert advice to help you find the best tips and deals for managing your bills. Start saving today!

While gold and silver have attracted the attention of some investors of late, there is a metal that is far, far rarer and has fundamentals that merit investment consideration. Some consider it the ultimate symbol of wealth - above and beyond gold, silver or platinum - because of its price and very significant rarity.

The metal in question is rhodium. Discovered along with palladium by British chemist and physicist William Wollaston in 1803, rhodium belongs to the platinum group metals (PGM) together with platinum and palladium.

Besides being a key component in the car industry, some of rhodium's other principal uses are in glass making; as a finish for mirrors and jewellery; in electrical connections; and in aircraft turbine engines.

MoneyWeek

Subscribe to MoneyWeek today and get your first six magazine issues absolutely FREE

Sign up to Money Morning

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

Don't miss the latest investment and personal finances news, market analysis, plus money-saving tips with our free twice-daily newsletter

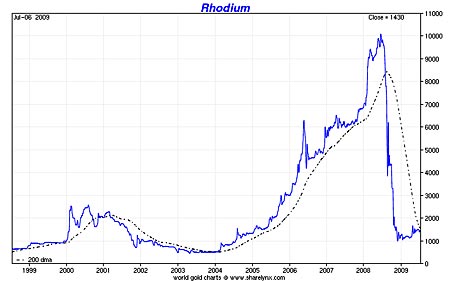

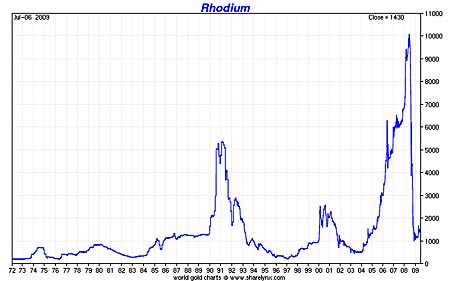

Price performance

Rhodium's price performance has been very volatile in recent years (see chart above and below). Its average price in 2003 was some $530/oz. Lack of supply led to a massive move up in price until 2008 when it briefly reached just over $10,000/oz.

Rhodium's primary use is in catalytic converters in automobiles. With the sharp decline of the global car industry, the price fell by more than 90%. Today, rhodium is trading at less than $1,600/oz.

Importantly, the average nominal price of rhodium over the last 40 years is some $1,500/oz (see chart below).

Supply demand fundamentals

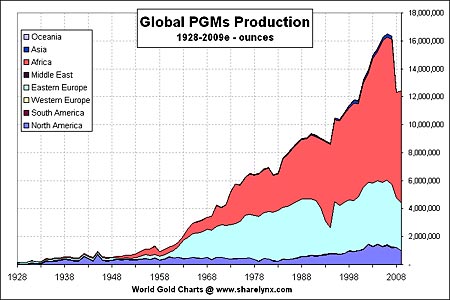

Annual world production of rhodium is extremely small. Johnson Matthey estimated that rhodium supply was 696,000 troy ounces in 2007, falling to 574,000 troy ounces in 2008. And this year, precious metals consulting firm CPM expects the supply to be down 3.1%.

In comparison, around 2,500 tonnes of gold are are produced every year. The annual production of rhodium is a mere 1% of gold's, yet its price is only about 50% more than gold (some $1,600/oz versus some $940/oz for gold).

Supply shortages came about due to the massive demand for catalytic converters by the automobile industry. And while demand for automobiles may have fallen sharply in recent months, the world will need internal combustion engines for the foreseeable future, and the growing importance of automobile industries in the developing world will likely become an important driving force in rhodium consumption and demand.

Resource nationalism and industrial unrest creates supply risk

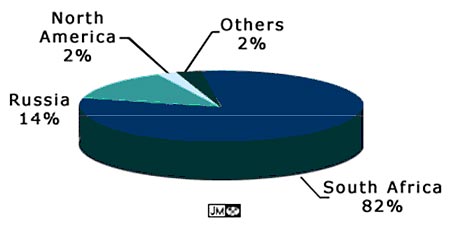

With 82% of world rhodium supply coming from South Africa and 14% from Russia, resource nationalism could become an issue. Russia has been increasingly flexing its muscles on the world stage and has been using its gas reserves as geopolitical leverage. The Russians temporarily stopped palladium shipments in 2001, resulting in palladium surging in value.

Rhodium Supply Breakdown

South Africa has recently seen a change of government and there is a shift to the left in South African politics. The powerful mining unions are becoming increasingly militant and there have been calls for national strikes and nationalisation of mines. There is also the matter of South Africa's extremely poor national electricity infrastructure, which has led to power outages and rationing of electricity. Analysts warn of continuing significant risks to mine production from these power issues.

Resource nationalism, protectionism and the threat of nationalisation could lead to export duties and export controls being introduced and thus the supply of rhodium could be greatly hampered.

Extremely rare metal in a world of dwindling finite resources

The world's finite natural resources, including its precious metals, are being used up at an unprecedented rate. And in the same way that the phenomenon of peak oil has been recognised in recent years, so too will the reality of peak metals be realised in the coming years. This should lead to the price of the earth's precious finite metals rising to higher prices - possibly much higher.

Investing in rhodium

Before investing in rhodium, people should realise that rhodium prices are quite illiquid due to the very small size of the market. It is inadvisable to actively trade rhodium as its price movements are volatile. Thus a buy and decide to take profits at a pre determined level and/or a buy and hold strategy would be advisable. Larger orders need to be placed over a period of days and weeks in order not to move the market and ensure a good average price.

Rhodium is a non-exchange-traded commodity and because it does not trade on the commodity exchanges it cannot be bought on margin like other commodities. Thus it cannot be bought using futures, exchange traded funds, contracts for differences (CFD's), spread betting or other derivatives. Rather, investors must opt for the far more conservative and safer route of owning the actual physical metal itself rather than paper derivatives. Unknown to most, investors can buy rhodium in metal form from specialist bullion dealers and store it in depositories internationally.

Neither Wall Street nor the investment public is particularly aware of rhodium, and only a tiny handful of investors and institutions internationally have it on their radar. Speculators have not bought rhodium - and indeed most investors and speculators have not even heard of rhodium.

Investors who own rhodium stored in international vaults are not exposed to the current elevated systemic and systematic risk. Unlike companies, banks and governments, rhodium cannot become insolvent.

Rhodium is finite and the rarest of precious metals. In a finite planet with a rapidly growing population and money printing and currency debasement on a scale not seen in modern times, rhodium is likely to at least preserve value in the coming years.

Thus, rhodium merits an allocation within the precious metals allocation of a properly diversified portfolio.

This article was written by Mark O'Byrne, director of Goldcore

Get the latest financial news, insights and expert analysis from our award-winning MoneyWeek team, to help you understand what really matters when it comes to your finances.

MoneyWeek is written by a team of experienced and award-winning journalists, plus expert columnists. As well as daily digital news and features, MoneyWeek also publishes a weekly magazine, covering investing and personal finance. From share tips, pensions, gold to practical investment tips - we provide a round-up to help you make money and keep it.

-

Average UK house price reaches £300,000 for first time, Halifax says

Average UK house price reaches £300,000 for first time, Halifax saysWhile the average house price has topped £300k, regional disparities still remain, Halifax finds.

-

Barings Emerging Europe trust bounces back from Russia woes

Barings Emerging Europe trust bounces back from Russia woesBarings Emerging Europe trust has added the Middle East and Africa to its mandate, delivering a strong recovery, says Max King